A companys statutory income is taxed at 30 with the exemption period beginning. Pioneer status often provides a 70 exemption of statutory income for a period of 5 years.

Ppt Tax Incentives Powerpoint Presentation Free Download Id 3275441

The same activity or product which has been granted pioneer status or.

. Eligible activities and products are termed. The salient features of these incentives are discussed below. What is a Pioneer status.

No extension of tax relief period for a further 5 years. Eligibility for Pioneer Status and Investment Tax Allowance is based on certain priorities including the level of value-added technology used and industrial linkages. Promotions of Investments Act 1986 - Investment Tax Allowance.

For projects with longer gestation. Pioneer Status PS and Investment Tax Allowance ITA Companies that have generally started production less than a year and fall under the promoted activity or promoted product criteria in the manufacturing food processing agricultural hotel tourism or other industrial or commercial sectors will be eligible to avail benefits under ITA or. The principle of pioneer status as a tax incentive is that companies in industries designated as pioneers are relieved from paying company income tax in their formative years to enable them to make a considerable profit for re-investment into the business.

Was incorporated in 2013 with a plant in Krubong Melaka to recycle and treat wastewater. Uses a design formula scheme method process or system. The alternative to pioneer status incentive is usually the investment tax allowance ITA.

Involves the manufacturing or processing not merely assembly or packaging of goods or raw materials that have not been produced in the Philippines on a commercial scale. The Pioneer Status PS program allows pioneering companies to receive tax exemptions for a period of five years. Period 5 years from production day 5 years 10 years.

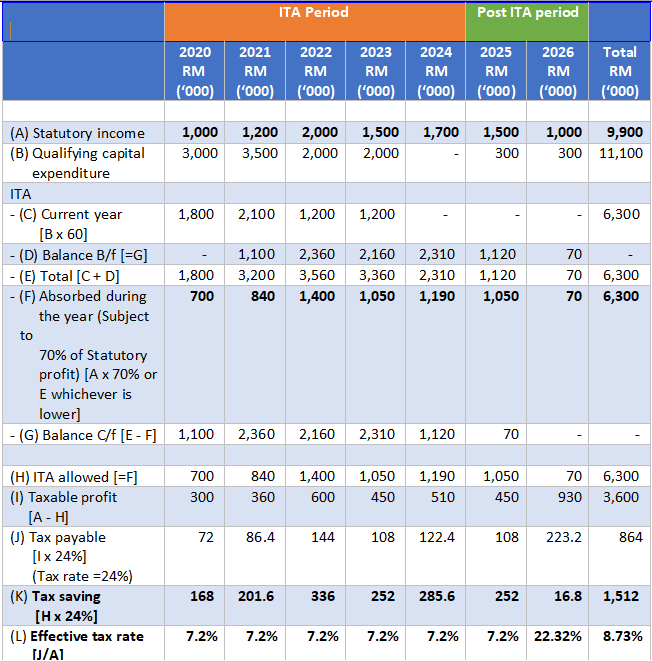

Tax exemption restricted to 70 of statutory income for 5 years. Minister a company granted pioneer status or issued with a pioneer certificate may surrender its pioneer status retrospectively so as to enjoy Although the Promotion of Investments Act 1986 covers more than one tax incentive only two pioneer status and investment tax allowance ITA are examinable in Paper P6 MYS. Pioneer status often provides a 70 exemption of statutory income for a period of 5 years but it is possible to extend both the quantum and the period of the exemption.

100 QCE 3 against 100 SI. This incentive is generally given for a period. 15 consecutive years Surrendering company Adjusted loss.

Unabsorbed pioneer losses and unabsorbed capital allowances can be carried forward to the post-pioneer period for companies with pioneer periods. 100 of SI 2 5 5. 1222019 Pioneer status investment tax allowance and reinvestment allowance ACCA Global 318 This article is relevant to candidates preparing for the Advanced Taxation ATX MYS exam.

Or Investment Tax Allowance of 60 on qualifying capital expenditure incurred for 5 years. It is a tax holiday granted for five years initial period of three years and renewable. A company approved with a Pioneer Status certificate can enjoy income tax exemption between 70 100 of statutory income for 5 to 10 years whereas for Investment Tax Allowance a company can get allowances between 60 100 on qualifying capital expenditure incurred within a period of 5 to 10 years.

Unabsorbed capital allowances not to be carried forward to post-pioneer period. Similar lists of promoted products or activities as applied for pioneer status would also be applied for ITA. The company had applied for pioneer status on 1112014 which was subsequently approved by MIDA.

The article is based on the prevailing laws as at 31 March 2018. Unabsorbed losses not to be carried forward to post-pioneer period. The company made up its accounts to 31 December and.

Pioneer Status PS The PS incentive is given in the form of direct exemption of profit from the payment of income tax for a period of 5 years certain companies are given 10 years up to 70 certain companies enjoy 100 of a companys statutory income income after deduction of allowable expenses and capital allowances. Pioneer status Investment Tax Allowance Reinvestment Allowance Group relief Allowance for increased exports. Justify why tax incentives especially Pioneer Status and Investment Tax Allowance are important as stimulus and as an economic factor to Malaysian Government.

TRP 1 Projects of national and strategic importance involving heavy capital investment and high technology. From pioneer status or investment tax allowance in respect of a similar product or activity. The company applied for pioneer certificate and its production day was determined at 132015.

ITA and pioneer status are mutually exclusive in respect of the same promoted activity or product. While pioneer status is an income-based tax incentive investment tax allowance is a capital expenditure-based one that generally provides for a. Investment Tax Allowance ITA An allowance of 60 100 on qualifying capital expenditure factory plant machinery or other equipment used for the approved project.

It may provide up to 10 years of tax holiday. High-technology companies engaged in areas of new and emerging technologies. Offset against 70 of the statutory income for each assessment year.

Unabsorbed capital allowances and accumulated losses incurred during the pioneer period can be carried forward and deducted from the post pioneer status of the company. New Existing Fixed assets and other conditions-. Pioneer Status PS The standard PS incentive is a partial exemption from the payment of income tax for a period of 5 years up to 70.

Pioneer Status equivalent to income tax exemption of 70 of statutory income for 5 years. Pioneer status and investment tax allowance are two of the main tax incentives available in Malaysia. While pioneer status is an income-based tax incentive investment tax allowance is a capital expenditure-based one that.

This article collates and discusses the provisions in the Income Tax Act 1967 the Act and the Promotion of. ITA is an incentive granted based on the capital expenditure incurred on industrial buildings plant and machinery used for the purpose of the promoted activities or the production of the promoted products. Some of the major tax incentives available in Malaysia are the Pioneer Status PS Investment Tax Allowance ITA and Reinvestment Allowance RA.

The major tax incentives for companies investing in the manufacturing sector are the Pioneer Status and the Investment Tax Allowance. Application for pioneer status received on or after 1111991. A preferred area of investments may be declared Pioneer if the activity.

A company approved with a Pioneer Status certificate can enjoy income tax exemption between 70 - 100 of statutory income for 5 to 10 years whereas for Investment Tax Allowance a company can get allowances between 60 - 100 on qualifying capital expenditure incurred within a period of 5 to 10 years. In Malaysia the corporate tax rate i View the full answer Transcribed image text.

Promoted Activities Mida Malaysian Investment Development Authority

Business And Investment Opportunities In The Machinery Equipment Supporting Engineering And Medical Devices Sectors In Malaysia Ppt Download

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

1 Incentives For The Aerospace Shipbuilding Shiprepairing Industries In Malaysia Malaysian Industrial Development Authority Ppt Download

Solved Blossom Sdn Bhd Bsb Is A Resident Manufacturing Chegg Com

Solved 7 The Mechanism Of Incentives 1 Point Under Pioneer Chegg Com

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

Ppt Tax Incentives Powerpoint Presentation Free Download Id 3275441

Ppt Tax Incentives Powerpoint Presentation Free Download Id 3275441

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Do You Run Or Own A Green Penang Green Council Facebook

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Q A Q2 Dec 2019 Q Amp A Q2 Dec 2019 Question 2 Forest Sdn Bhd Fsb Is A Resident Company Involves Studocu

Pioneer Status Investment Tax Allowance And Reinvestment Allowance Acca Global

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Malaysian Investment Development Authority 30 August 2016 Incentives And Grants Ppt Download

Www Mida Gov My Ica Ja Ik Ja Crd Amp Fp Guidelines And

- jubin lantai bilik air

- model lemari hiasan ruang tamu

- finish sanding epoxy table

- fifa online 4 release date malaysia

- minyak belacak untuk lelaki

- maybank current account transfer limit

- aeon co. (m) bhd.

- epoxy river table colors

- atita nama dalam islam

- chinese new year cartoon

- contoh surat persetujuan dari orang tua

- malay to tamil translate

- hong leong bank melaka

- abdullah hukum lrt to midvalley

- undefined

- pioneer status and investment tax allowance

- kwsp i lestari semakan status permohonan

- jadual komuter padang besar

- resipi daging sk merah

- isyana sarasvati tiga titik hitam